Read the Press Release on the SEC website.

Digital World Acquisition Corp. Provides Additional Guidance on October 10, 2022 Special Meeting

The Company recommends its stockholders to vote FOR the Extension Amendment

Miami, FL, September 15, 2022 — Digital World Acquisition Corp. (Nasdaq: DWAC) (“DWAC”, “Digital World” or the “Company”) today provided an update on this week’s events and the status of its stockholder vote for is special meeting of stockholders (the “Special Meeting”) to approve an amendment to the Company’s amended and restated certificate of incorporation (“Extension Amendment”) to extend the period of time available to complete a business combination:

• Where does the vote stand? The vote is continuing, any reports to the contrary may be inaccurate or misleading, and in fact the votes that have been received for the proposals have been overwhelmingly positive. We have hundreds of thousands of shareholders in our Company, which is unlike many other SPACs and is, in our belief, a testament to our shareholders’ interest in our acquisition target. However, the sheer number of voters and voter interest have compelled us to keep the polls open, to meet quorum and to meet the requisite favorable vote of 65% of outstanding shares required by our charter. We firmly believe that the Extension Amendment will pass, so long as all shareholders have a chance to get their vote counted.

• When does DWAC expire? Under DWAC’s existing governing documents, we have at least 6 months available to complete a business combination, available to be taken in two three-month increments, subject to additional sponsor funding. As of September 8, 2022, we have received the requisite sponsor funding for the first three-month extension period, so we now have until at least December 8, 2022 to complete a business combination.

• What will the shareholder vote achieve? The shareholder vote that we are seeking will give us up to one full year (or an additional 6 months past what our charter currently permits) to close a business combination. A “FOR” vote will give us until September 8, 2023 to complete a transaction. DWAC is very much alive, and we are continuing work diligently for all our stockholders. Any reports to the contrary may be inaccurate or misleading.

• Where can I find more information? We encourage stockholders and interested parties to read the Company’s public filings and statements, available on www.sec.gov, www.dwacspac.com, and through TruthSocial @patrickorlando, for comprehensive information about DWAC and the Special Meeting. The Company will be providing regular updates on any material developments for DWAC and the Special Meeting through these sites/platforms.

• Who can vote? Please note that you must be a stockholder of DWAC common stock as of August 12, 2022, the record date for the Special Meeting, in order to cast a vote. Stockholders as of the August 12, 2022 record date can vote, even if they have subsequently sold their shares. DWAC warrantholders are not entitled to vote at this time. Please see our definitive proxy statement for more information about who is eligible to vote.

• What if my broker says this is a Tender Offer? This is an important vote that includes a redemption right. You should vote, and if you don’t redeem now you keep your right to redeem in connection with the business combination.

• What if my broker says they are not participating in this vote? You should contact us at info@dwacspac.com and advise the help desk of the issue. You have the right to vote and we will help you contact your broker accordingly.

• What if I want to contact the SEC about its review of the DWAC TMTG proposed merger? You should contact your attorney and/or you can call various resources at the SEC for investors, such as the SEC Office of the Investor Advocate Marc Sharma, Chief Counsel, at202-551-3302, https://www.sec.gov/advocate, or the SEC Acting Ombudsman Latisha Brown at https://omms.sec.gov or Ombudsman@sec.gov.

• How can I vote? The easiest way for stockholders to vote is to contact our new proxy solicitor, Alliance Advisors LLC, at (877) 728-4996 or by email at DWAC@allianceadvisors.com. They will assist you with voting questions from 9am to 10pm EST, Monday through Sunday.

• When is the deadline to vote? Votes will be accepted up to and during the October 10, 2022 meeting, however if you hold shares in “street” name, we strongly encourage you to vote early to give your broker sufficient time to record your vote.

• What if I already voted? Stockholders as of August 12, 2022 who have previously submitted their proxy or otherwise voted and who do not want to change their vote need not take any action.

• What if I owned shares on August 12, 2022 but have sold since? Stockholders as of August 12, 2022 who have not yet voted can still exercise their right to vote for the shares they held as of August 12, 2022. We strongly encourage those who owned shares on August 12, 2022 to exercise their right to vote whether or not they have sold their shares since.

• Can I still redeem my Class A shares, and if so, how? We have extended the redemption deadline for holders of Class A common stock issued in our initial public offering to 5:00 p.m. Eastern Time on October 7, 2022. Stockholders who wish to withdraw their previously submitted redemption request may do so prior to this time by requesting that the transfer agent return such shares. Our sponsor’s September 8, 2022 contribution has increased the per share redemption price from approximately $10.20 per share to approximately $10.30 per share.

• What if I hold my shares at Robinhood? Please be advised that Robinhood acquired Say Technologies in August 2022, as a result you may receive emails from Say Technologies related to your Robinhood account. Please do not delete emails from Say Technologies since they may contain important voting information for your Robinhood account. Also please check your spam folder for emails from Say Technologies.

The Company recommends all of its stockholders to vote “FOR” the proposals submitted at the Special Meeting. Stockholders should endeavor to cast their votes prior to the Special Meeting online at their broker’s website or app, by phone at (877) 728-4996, or by emailing the Company’s proxy solicitor, Alliance Advisors LLC, at DWAC@allianceadvisors.com.

New Proxy Solicitor

DWAC has engaged a new proxy solicitor, Alliance Advisors LLC (the “Proxy Solicitor”), to assist in the solicitation of proxies for the October 10, 2022 Special Meeting. We have agreed to pay the Proxy Solicitor a fee of $10,000 plus approved disbursements and out-of-pocket expenses, including campaign efforts calculated on a per-communication and per-vote basis. We will also reimburse the Proxy Solicitor for reasonable out-of-pocket expenses and will indemnify the Proxy Solicitor and its affiliates against certain claims, liabilities, losses, damages and expenses. The Proxy Solicitor does not beneficially own any of our securities, nor has it purchased or sold any of our securities during the past two years, and to our knowledge there is no information regarding the Proxy Solicitor or any of its affiliates or associates required to be set forth in our proxy statement that is not set forth therein. Our directors, officers and their respective agents may also solicit proxies in person, by telephone or by other means of communication. We will not pay these parties any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. While the payment of these expenses will reduce the cash available to us to consummate an initial business combination if the Extension Amendment is approved, we do not expect such payments to have a material effect on our ability to consummate an initial business combination.

Additional Information and Where to Find It

Digital World urges investors, stockholders and other interested persons to read the definitive proxy statement dated August 25, 2022 (the “Extension Proxy Statement”), as well as other documents filed by Digital World with the Securities and Exchange Commission (the “SEC”), because these documents contain important information about Digital World and the Extension Amendment. The Extension Proxy Statement was first mailed to stockholders of Digital World as of a record date of August 12, 2022, on August 25, 2022. Stockholders may obtain copies of the Extension Proxy Statement, without charge, at the SEC’s website at www.sec.gov, www.dwacspac.com, or by directing a request to: info@dwacspac.com.

Digital World has filed with the SEC a registration statement on Form S-4 (as may be amended from time to time, the “Registration Statement”), which includes a preliminary proxy statement of Digital World, and a prospectus in connection with the proposed business combination transaction (the “Business Combination”) involving Digital World and Trump Media & Technology Group Corp. (“TMTG”). The definitive proxy statement and other relevant documents will be mailed to stockholders of Digital World as of a record date to be established for voting on the

Business Combination. Securityholders of Digital World and other interested persons are advised to read the preliminary proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with Digital World’s solicitation of proxies for the special meetings to be held to approve the Business Combination because these documents will contain important information about Digital World, TMTG and the Business Combination. Digital World securityholders and other interested persons will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to: Digital World Acquisition Corp., 3109 Grand Ave., #450, Miami, FL 33133.

Participants in Solicitation

Digital World and TMTG and certain of their respective directors, executive officers, other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies from the securityholders of Digital World in favor of the approval of the proposed Extension Amendment and the Business Combination. Securityholders of Digital World and other interested persons may obtain more information regarding the names and interests of Digital World’s directors and officers in the proposed Extension and the Business Combination in Digital World’s filings with the SEC, including the Extension Proxy Statement and the Registration Statement, and the names and interests of TMTG’s directors and officers in the proposed Business Combination in the Registration Statement. These documents can be obtained free of charge from the sources indicated above. TMTG and its officers and directors do not have any interests in Digital World or the proposed Extension Amendment other than with respect to their interests in the Business Combination, to the extent the Extension Amendment is effectuated.

Non-Solicitation

This press release is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Extension Amendment or Business Combination and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of Digital World, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Forward Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed Extension Amendment and the proposed Business Combination between Digital World and TMTG, including without limitation statements regarding the uncertainties relating to Digital World’s stockholder approval of the Extension Amendment, the anticipated benefits of the Business Combination, the anticipated timing of the Business Combination and the private placement of Digital World (the “PIPE”), the implied enterprise value, future financial condition and performance of TMTG and the combined company after the closing and expected financial impacts of the Business Combination, the satisfaction of closing conditions to the Business Combination, the level of redemptions of Digital World’s public stockholders and the products and markets and expected future performance and market opportunities of TMTG. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) the risk that the Business Combination and the PIPE may not be completed in a timely manner or at all, which may adversely affect the price of Digital World’s securities, (ii) the risk that the Business Combination may not be completed by Digital World’s Business Combination deadline and the potential failure to obtain Digital World’s stockholder approval of the Extension Amendment, (iii) the failure to satisfy the conditions to the consummation of the Business Combination or the PIPE, including the approval of an Agreement

and Plan of Merger, dated October 20, 2021 (as amended by the First Amendment to Agreement and Plan of Merger, dated May 11, 2022, and as it may further be amended or supplemented from time to time, the “Merger Agreement”) by the stockholders of Digital World, (iv) the lack of a third-party fairness opinion in determining whether or not to pursue the proposed Business Combination, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the failure to achieve the minimum amount of cash available following any redemptions by Digital World stockholders, (vii) redemptions exceeding a maximum threshold or the failure to meet The Nasdaq Stock Market’s initial listing standards in connection with the consummation of the contemplated transactions, (viii) the effect of the announcement or pendency of the PIPE or the Business Combination on TMTG’s business relationships, operating results, and business generally, (ix) risks that the Business Combination disrupts current plans and operations of TMTG, (x) the outcome of any legal proceedings that may be instituted against TMTG or against Digital World related to the Merger Agreement or the Business Combination, (xi) the risk of any investigations by the SEC or other regulatory authority relating to the PIPE, the Merger Agreement or the Business Combination and the impact they may have on consummating the transactions, (xii) TruthSocial, TMTG’s initial product, and its ability to generate users and advertisers, (xiii) changes in domestic and global general economic conditions, (xiv) the risk that TMTG may not be able to execute its growth strategies, (xv) risks related to the ongoing COVID-19 pandemic and response and geopolitical developments, (xvi) risk that TMTG may not be able to develop and maintain effective internal controls, (xvii) costs related to the Business Combination and the failure to realize anticipated benefits of the Business Combination or to realize estimated pro forma results and underlying assumptions, including with respect to estimated stockholder redemptions, and (xviii) those factors discussed in Digital World’s filings with the SEC and that that will be contained in the Extension Proxy Statement and the Registration Statement relating to the Business Combination. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in the “Risk Factors” section of Digital World’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, the Extension Proxy Statement, the Registration Statement and other documents to be filed by Digital World from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and while Digital World and TMTG may elect to update these forward-looking statements at some point in the future, they assume no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise. Neither of Digital World or TMTG gives any assurance that Digital World, TMTG, or the combined company, will achieve its expectations.

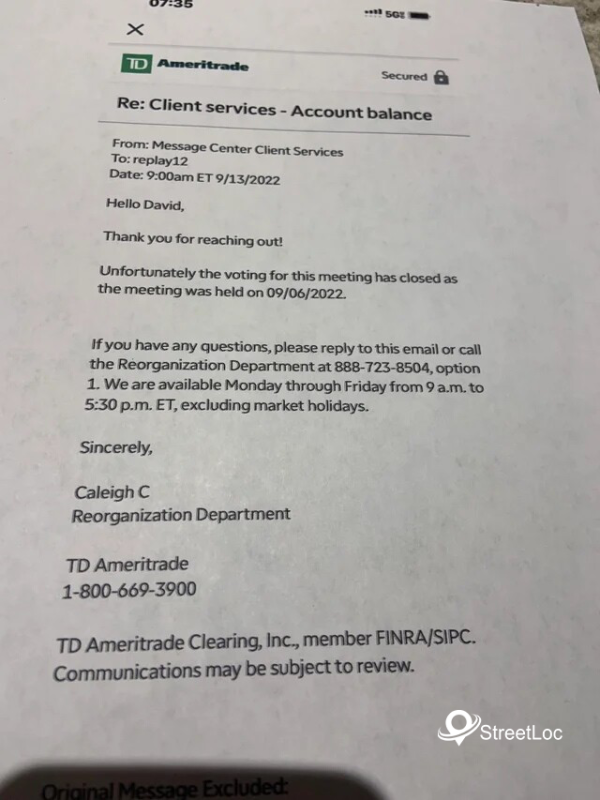

People are saying that TD Ameritrade claim that the DWAC vote is closed... this is not true.

Read the Press Release on the SEC website..

When is the deadline to vote? Votes will be accepted up to and during the October 10, 2022 meeting, however if you hold shares in “street” name, we strongly encourage you to vote early to give your broker sufficient time to record your vote.

How can I vote? The easiest way for stockholders to vote is to contact our new proxy solicitor, Alliance Advisors LLC, at (877) 728-4996 or by email at DWAC@allianceadvisors.com. They will assist you with voting questions from 9am to 10pm EST, Monday through Sunday.

Potentially a new threat to Truth Social...

The same federal Magistrate Judge who signed the search warrant allowing FBI Agents to raid President Trump, also signed a second Warrant the same day allowing FBI to install "Pen Registers" on Trump computers and electronic eavesdropping devices in Trump's home.

It is not known at this time if that software will also spread to other networks for which the local computer may also have access. For instance, if there is "Remote Desktop" set up so a computer in Trump's Palm Beach Home can connect to his corporate computers in New York City, there is the possibility that the Pen Register software can be programmed to infect that remote computer and its network too!

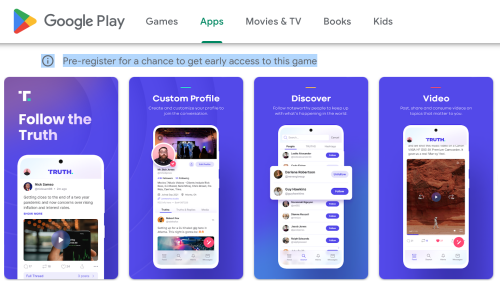

Donald Trump's Opinions Will Soon Be Available To Android Users. (If you don't want to wait you can follow Donald J. Trump here. Get it on Android or Apple.)

For TruthSocial on Android you have to pre-register for what the Google Play Store is calling a "Game" while saying this app may collect your:

- Personal Info

- Messages

- Photos and Videos

- Contacts

- App Activity

- App Info and Performance

- Device or other ID's

In a nutshell it sounds like TruthSocial collects all your personal information on your phone.

'What the f*** is going on?': Donald Trump is 'complaining about lackluster Truth Social rollout' and 'wants to know why his app isn't dominating the charts'

- Truth Social shot to the top spot in Apple's App Store when it debuted in Feb

- As of Monday morning it had dropped to 118th in download popularity

- An attempt to sign on by DailyMail.com ends at a waitlist 584,200 spots long

- Saturday data analysis shows users spending far less time on Truth Social than other right-wing social media sites like Gab and Gettr

- A mobile app expert predicted to DailyMail.com the day after the app's launch that Trump will 'pack up his bags, and so too will the remaining platform users'

Trump will launch his new social media platform TRUTH on February 21, Presidents Day, after being valued at $5.3 billion

- App Store listing shows Donald Trump's social media app will launch on Feb 21

- His company's share price rose on the news, valuing it at $5.3 billion

- Trump has harbored plans since being banned by Facebook and Twitter last year

- The app is the first phase of a media venture which will include a video platform

#TruthSocial #FollowTheTruth

Howard Lutnick, the CEO of Rumble's parent company Cantor Fitzgerald, stated on Monday that they have worked out a distribution deal with Donald Trump's planned "Truth" social media platform.

"Truth and the 45th president are going to use Rumble's infrastructure, their technology, their cloud distribution capability, so they are going to be a service provider, a tech provider to the president's Truth Social," Lutnick told interviewer John Bachman on his "John Bachman Now" show.

-

·

·#TruthSocial apps are expected to be available on February 21, 2022The SctreetLoc Android app is available on Google Play here:

B